The DCA Strategy in Crypto: When It Works, and When It Fails

In the highly volatile world of cryptocurrency, DCA (Dollar-Cost Averaging) has become a go-to strategy for many investors. Its simplicity and emotional neutrality make it attractive — especially for those who want to avoid timing the market.

But while DCA can be powerful, it’s not a one-size-fits-all solution. Used the wrong way, it can quietly drain your portfolio.

So what exactly is DCA, and when should — or shouldn’t — you use it?

What is DCA?

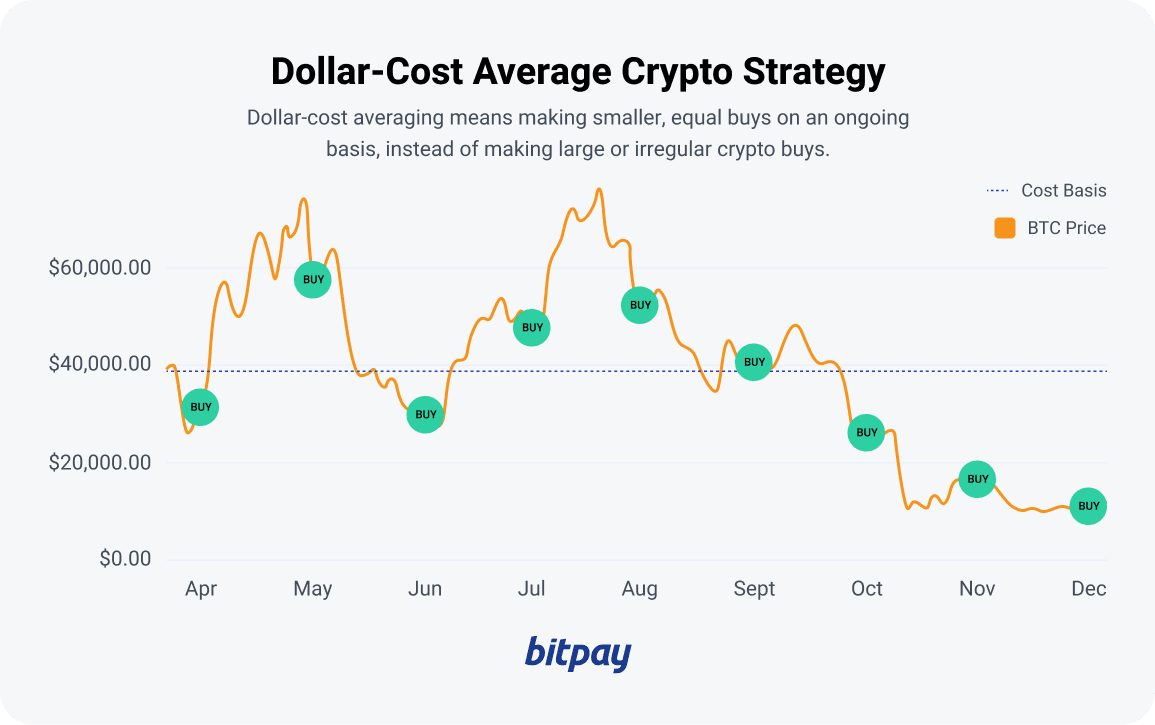

Dollar-Cost Averaging (DCA) is an investment strategy where you divide your total investment into equal portions and buy at regular intervals, regardless of market price.

Example:

You want to invest $1,000 in Bitcoin. Instead of buying all at once, you decide to buy $100 worth every week for 10 weeks — regardless of whether BTC goes up or down.

Pros of the DCA Strategy

✔️ Reduces the risk of buying the top – No need to time the perfect entry.

✔️ Removes emotion from decisions – You invest based on a schedule, not fear or greed.

✔️ Beginner-friendly – No need for technical analysis or constant monitoring.

✔️ Ideal for long-term believers – Works well if you expect the asset to rise over time.

When is DCA effective?

-

During downtrends or accumulation phases

- → Helps average in at lower prices as the market gradually bottoms.

-

When investing in strong, long-term projects

- → Assets like BTC, ETH, or established blue-chip coins.

-

For long-term investors

- → DCA is not a short-term flip strategy. It’s for those playing the long game.

-

If you don’t have time to watch the market 24/7

- → Let a bot execute scheduled buys for you, hands-free.

When DCA can fail (or even destroy your portfolio)

-

Using DCA on “shitcoins” or hype tokens

- → If the asset crashes 95%+ and never recovers, DCA only increases your losses.

-

Bear markets that last too long

- → If the price keeps dropping for 1–2 years, your portfolio may bleed continuously.

-

No exit strategy

- → DCA is a buy-side strategy — but without a sell plan, gains can vanish fast during a reversal.

-

Combining DCA with leverage

- → DCA with margin or futures is highly risky. One major dip can liquidate you before the price bounces back.

DCA + Bot = Smarter & Safer Execution

At LightQuant, we offer intelligent DCA bots that make your strategy safer and more effective:

🔹 Automatically execute buys on your schedule

🔹 Pause or stop when markets break risk thresholds

🔹 Combine with take-profit and stop-loss targets

🔹 Fully compatible with major exchanges like Binance, OKX, and Bybit

DCA is powerful — when used at the right time, with the right tools.

Let LightQuant help you DCA smarter, not harder.

Ready to Try AlphaX?

Experience the AI trading bot featured in this article with a 7-day free trial.